Why choose Jee

We are dedicated to offering top-tier training in oil, gas and renewable energy. Our courses are crafted to guide professionals towards excellence in these dynamic fields. Explore a world where knowledge meets innovation, and empower your career with the skills of tomorrow.

Our Courses

Hydrogen: From Production to Market

Carbon Capture Utilisation and Storage

Offshore Wind Power Cable Management

Offshore Wind

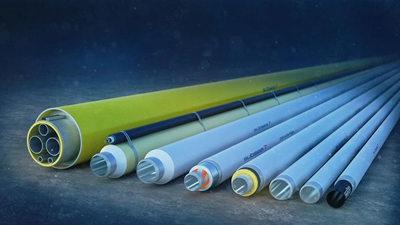

Subsea Power Cables

Harnessing Hydrogen Fuel Cells for a Sustainable Future

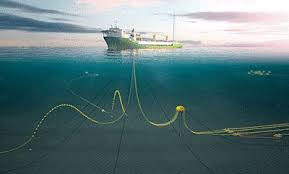

Subsea Systems and Hardware

Design of Subsea Pipelines

Further Design of Subsea Pipelines

Subsea Appreciation

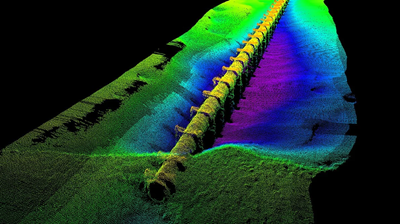

Subsea Pipelines

Construction of Subsea Pipelines

%20small.png?width=400&height=280&name=Enhanced%20Efficiency%20(1)%20small.png)

Decommissioning Programme Development and Execution

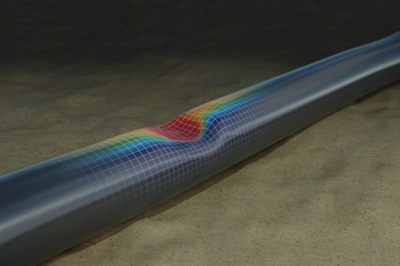

Integrity Management of Subsea Pipelines

Integrity Management Flexibles and Risers

Integrity Management: Lessons Learned

%20small.png?width=400&height=225&name=Integrity%20Management%20Pipe%20Blog%20Image%20(1)%20small.png)

Offshore Remedial Works

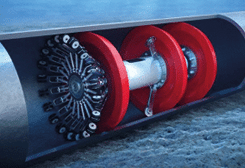

Pigging and Plugging

Planning and Executing Subsea Intervention

Subsea Controls

Subsea Project Delivery

Subsea Project Management

Corrosion Defect Assessment

Cost and Schedule Estimation for Subsea Projects

Dynamic Riser Analysis

Installation Calculations for Subsea Pipelines

Installation Analysis of Subsea Structures and Sea-Fastenings

Lifetime Extension of Rigid Pipelines and Flexibles

Reel-Lay Engineering

HDVC Grid Connection of Offshore Wind Farms

Onshore Pipelines

%20small.png?width=400&height=282&name=Economic%20Optimisation%20(1)%20small.png)

Meet our tutors

Our courses are led by industry experts with extensive experience in subsea engineering and asset integrity. With practical insights and hands-on learning, our tutors ensure you gain the skills to excel in your field, guiding you through real-world applications of today’s industry challenges.